Business

Top CBD companies experience market share drop as online sales soften

The largest CBD companies in the U.S. experienced declining market share in the second quarter, as the return of in-person shopping triggered a decline in e-commerce sales.

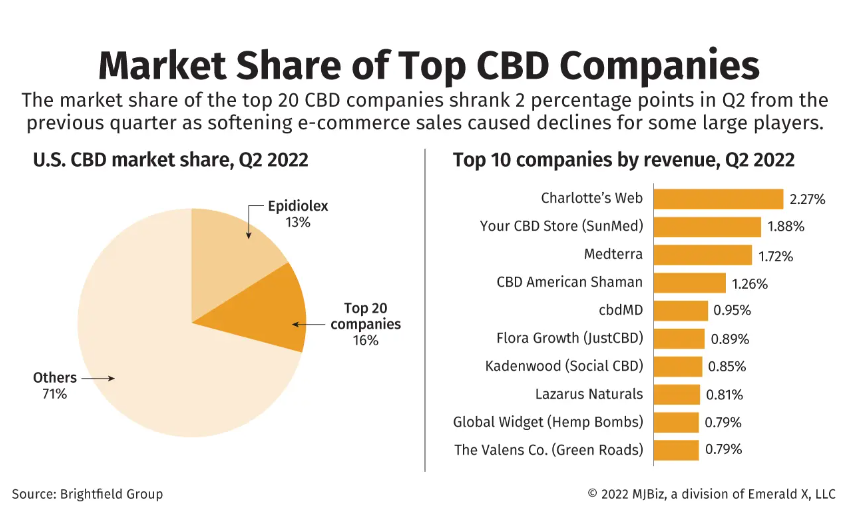

Market share by revenue for the top 20 CBD brands shrank 2 percentage points, to 16%, versus the first quarter of the year, according to Chicago-based cannabis analytics firm Brightfield Group.

That is the smallest share for the sector in the past four quarters. The brands’ share of overall CBD sales peaked in the fourth quarter of 2021, at 18.9%.

Bethany Gomez, Brightfield’s managing director, said the declining market share reflects a broader trend in the direct-to-consumer category, with consumers returning to stores after having shopped online following the outbreak of the COVID-19 pandemic in early 2020

“There’s still a very strong percentage of consumers that are buying online, but people are ready to explore a little bit more,” Gomez said.

“They’re going out to stores. They’re going out to farmers markets. They’re going out to all these kinds of independent retailers that are starting to now pick up a larger percentage of share.”

That shift has allowed smaller CBD companies to increase their share of overall sales to 71% in the second quarter, up from 67% in the first.

In addition, independent pharmacies that previously were a strong revenue source for CBD brands also have returned, having earlier focused their attention on COVID-19 testing and vaccinations.

That one-two combination is spurring large CBD companies to possibly pivot back to brick-and-mortar sales after having shifted large parts of their operations to online sales as pandemic lockdowns stalled in-person shopping.

Charlotte’s Web, which Brightfield ranks No. 1 among CBD brands, reported that its direct-to-consumer online sales decreased 15.3%, or $2.4 million, to $13.3 million in the second quarter from a year earlier as fewer people visited the Colorado company’s e-commerce website.

That said, Charlotte’s Web still leads online CBD sales with 2.7% of the market in the second quarter. It also ranked third in brick-and-mortar sales, according to Brightfield, with 1.9% of that sector.

When it comes to CBD, online selling remains the dominant distribution channel, accounting for 39.2% of overall sales.

Pharmacies follow with a 19.5% share while CBD specialty retailers make up 10.7%.

Overall, the CBD market rankings are stable at the top.

Movement by revenue remained largely unchanged among the top 20 brands compared to the first quarter, except for the addition of Flora Growth.

The cannabis cultivator and product manufacturer now ranks sixth following its acquisition of JustCBD brand in early 2022 for $16 million plus privately issued shares.

Gomez believes the continued strength of sales at independent retail outlets will stave off any consolidation the industry might have expected.

“There’s just not any big forces pushing that aspect forward, so we’re just continuing to see all of these tiny little players operate in small areas of the country through small independent channels now, with few of them really being able to scale up further,” she said.

Sales of the prescription drug Epidiolex, a highly purified CBD oil used to treat rare forms of epilepsy, continues to claim a significant portion of the U.S. CBD market.

Tracked separately from consumer CBD by Brightfield, the drug accounted for 13% of the total U.S. CBD market by revenue, a decline from a 15% share in the first quarter.

But overall sales are up.

Also available in the United Kingdom, Germany, Italy, Spain, and soon France, global net sales of Epidiolex – known as Epidyolex outside the U.S. – increased 12%, to $175.3 million, in the second quarter on a proforma basis versus the same period in 2021.

Jazz Pharmaceuticals, which acquired the cannabis drug maker GW Pharmaceutical last year, said the increase in sales was due to higher sales volume and price increases in 2021 and 2022.

Source: https://mjbizdaily.com/top-cbd-companies-experience-market-share-drop-as-online-sales-soften/