Government

Rhode Island, Mississippi, Maryland lead 2022 marijuana legalization via legislatures

(This story has been updated to correct the number of dispensary licenses that can be owned by one entity in Mississippi.)

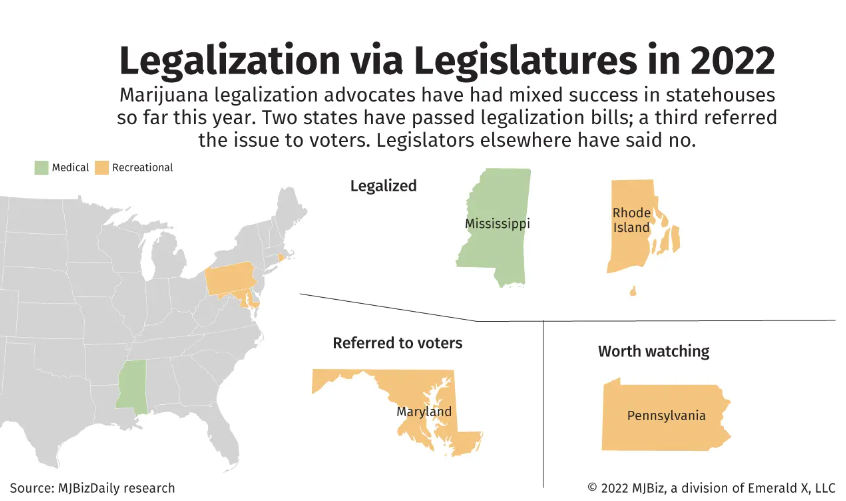

Marijuana legalization advocates have had mixed success so far this year in statehouses across the country.

They’ve scored legislative victories in Rhode Island, Mississippi and Maryland, laying the groundwork for hundreds of millions of dollars in combined sales for recreational and medical cannabis companies in those states.

At the same time, however, industry advocates have suffered defeats in several states, including Kansas, North Carolina and South Carolina.

Those losses underscore the hurdles cannabis industry advocates face in states where Republicans control one or both houses of the legislature and/or the governor’s mansion.

Now that more state legislatures have adjourned for the year, here’s a summary of the industry victories as the first half of 2022 winds to a close:

- Rhode Island became the 19th state to legalize recreational marijuana. The market is expected to launch Dec. 1, with existing medical cannabis operators getting the first crack at sales.

- Mississippi became the 39th state to legalize medical marijuana, a year after the state’s highest court voided a voter-approved referendum. The state opened its licensing-application process earlier this month and is on track for sales to start by the end of the year or early 2023.

- Maryland lawmakers referred the issue of recreational marijuana to voters, who are expected to approve a legalization initiative in November. Assuming the measure passes, lawmakers will need to agree on a licensing and regulatory structure. Sales are expected to start in 2024 or 2025.

Elsewhere, Pennsylvania’s Legislature remains in session, and the state faces increasing pressure to legalize adult-use sales to match neighboring New Jersey.

But Senate Republicans in Pennsylvania remain a formidable obstacle, and legalization this year would be a big surprise.

While legalization bills failed in a number of other states, they did advance further along than previously in Delaware (recreational), North Carolina (medical) and South Carolina (medical).

A slim chance remains that North Carolina lawmakers could approve a medical marijuana measure. But experts don’t expect it to pass this year.

“Almost all of the states that have not yet legalized have GOP control over one or both chambers and/or the governor’s mansion,” Karen O’Keefe, state policies director for the Washington DC-based Marijuana Policy Project (MPP), told MJBizDaily.

“Delaware and Hawaii are the only two states with a Democratic trifecta that haven’t legalized (recreational marijuana) yet, and both states’ governors are opposed,” O’Keefe added in an email.

In short, O’Keefe wrote, “the low-hanging fruit has been picked, and more challenging states remain. And even in states with Democratic trifectas, it took years of organizing and work to get legalization past the finish line.”

O’Keefe added that while states continue to legalize marijuana in some form, lawmakers in most states continue to lag far behind their constituents when it comes to supporting legalization.

She also noted that, for the first time, a Democratic governor actually spiked a legalization bill.

Delaware Gov. John Carney vetoed a bill that would have legalized marijuana possession and gifting. The measure would not have established a commercial marijuana market.

In addition to legislative activity, as many as five marijuana legalization measures could be on state ballots this fall.

South Dakota already has qualified an adult-use measure, and Arkansas, Missouri, North Dakota and Oklahoma remain possibilities, O’Keefe wrote.

South Dakota’s is a narrow referendum that would legalize possession and home cultivation. But it would not pave the way for a commercial marijuana market.

Here’s a more detailed look at the three states where legalization legislative victories have been secured this year:

Rhode Island

Existing medical cannabis dispensaries, called compassion centers in Rhode Island, will be able to obtain a hybrid license on Dec. 1 to begin adult-use sales.

Medical marijuana operators will need to pay $125,000 into a social equity fund, according to a bill summary from MPP.

The existing industry is small. The state issued five additional medical marijuana dispensary licenses last October, but that will increase the number of retail outlets across the state only to nine.

Here are some other key business details involving the legalization bill:

- New retail licensing: In addition to the existing MMJ operators, 24 new retail recreational marijuana licenses will be issued across six geographic regions. That will include at least one social equity permit and one worker-owned cooperative license in each geographic region. Retailers will be required to establish a so-called labor peace agreement with a union.

- Cultivation: While Rhode Island doesn’t have many retail outlets, the state has more than 60 MMJ cultivators. They will be granted adult-use licenses provided they are in good standing. The state will have a moratorium on issuing new cultivation licenses for two years after adult-use rules and regulations are finalized.

- Local bans: Municipalities can opt out of the adult-use industry, except in areas that currently have medical cannabis dispensaries.

- Taxes: A retail excise tax of 10% will be implemented in addition to the current sales tax of 7%. A local tax of 3% also may be implemented.

Mississippi

Medical cannabis regulators in Mississippi opened the licensing application process in June for growers, processors, testing facilities and transporters, but it could be year-end or early 2023 before sales start.

There is no cap on the number of licenses the state can issue, but the law allows municipalities to opt out.

Eighty municipalities and 19 counties had decided to ban dispensaries as of May 23, according to state Department of Revenue data. Residents in those municipalities could petition for a referendum on the issue.

The most restrictive provisions involve purchase limits and product-potency caps.

Patient purchases will be limited to about 3 ounces of marijuana a month. That’s lower than the 5-ounce-a-month limit in the 2020 referendum that was passed but later thrown out by the courts.

Lawmakers also imposed a potency cap of 30% THC for flower and 60% for concentrates, oils and tinctures.

Other key business elements include:

- Cultivation: MMJ must be grown indoors. There will be six cultivation tiers, ranging from a micro-cultivator capped at 1,000 square feet to a Tier 6 grower with 100,000 square feet or more.

- Seed-to-sale: A tracking system will be created, and the new law calls for criminal penalties for violations.

- Ownership: No individual or business will be allowed to have more than a 10% ownership interest in more than one cultivation license, one processing license or five dispensary licenses.

- Taxes: A 5% excise tax will be imposed on wholesale in addition to the state sales tax (currently 7%) for retail sales.

The 2022 MJBizFactbook projects that Mississippi medical marijuana sales will reach $80 million to $97.5 million in the first full year and as much as $627 million by 2026.

Maryland

Lawmakers in Maryland referred recreational marijuana legalization to the voters in November. The resulting ballot measure is expected to pass.

It won’t be such a quick process to market launch, however.

Assuming voters approve legalization, lawmakers will need to agree on a licensing and regulatory structure.

That process could be completed in the 2023 legislative session, but some final details might extend into 2024.

That’s because lawmakers are hesitant to act before the expected release in mid-2023 of a so-called “disparity study” that will help determine how to develop a diverse, equitable recreational marijuana industry.

Once a regulatory structure is in place, it will take another year or so for final regulations to be developed, licensing to take place and businesses to build their operations.

Some industry officials say that could push a market launch to 2025.