Business

Property ownership is key when looking for investors, cannabis cultivator says

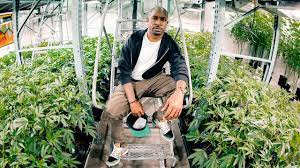

When Jesce Horton began looking for his first warehouse to cultivate cannabis in Oregon’s regulated market, landlords for Portland properties routinely charged marijuana companies three to eight times as much per square foot as their mainstream counterparts.

“We were in a really unfavorable lease, one that we were excited to have,” Horton told MJBizMagazine of Lowd’s entry into the regulated marijuana market.

In order to secure a lease on the property, Lowd prepaid a large portion of the rent, only to lose the lease because of some fine-print zoning issues. The story was a common one in the early days of regulated marijuana, Horton said.

Onward and upward

Today, the craft cannabis producer is operating out of its longtime headquarters while building out a new campus about 5 miles from downtown Portland.

Lowd first signed a purchase agreement for the new location, formerly an auto-wrecking facility, in 2016. Licensing and permitting issues delayed the project, and the purchase finally went through in 2021.

“It was a five-year purchase agreement at 0% interest, with all the money going toward the purchase price,” Horton said. “So, it was a really great agreement, but there were a lot of ups and downs in between that prevented us from being able to get in there and operate.”

Language in the purchase agreement for Lowd’s campus property specified that the company could assign it to another party. During the five-year span between purchase agreement and sale, Horton said he was approached several times by groups offering a sale-leaseback, though ultimately he decided against it.

“Being a Black entrepreneur, the idea of owning real estate is something that we’ve always strived to do. So, I had a lot of things holding me back from seriously considering the sale-leaseback,” Horton said.

Rearview mirror

Now that Lowd is actively building the facility, Horton said he is pleased that his company maintained ownership.

“I certainly understand the temptation of doing a sale-leaseback. Given this investment market … you’ve got to do what you’ve got to do,” Horton said. “However, in a more saturated market like Oregon—one that is also very depressed from an investment standpoint—the ability to get funding, even when you are a top brand or are doing fairly well, is very bleak.

“When we go to the investment market, we can say. ‘Hey, we’ve got about $2 million of equity.’ … And it is way less risky for people to say. ‘OK, sure, we’ll give you this amount of money,’” he said. “I don’t know how we would have been able to continue moving forward, investing in our brand and in our company, without having that real estate. I think it would have been impossible.”