Business

High cost of raising capital in marijuana industry expected to continue in 2023

Many marijuana companies seeking capital are expected to find limited pickings and costly terms this year, providing little relief from 2022, when the amount of money ponied up by investors tumbled more than 60% from the year before.

Still, investors are expected to open their checkbooks for certain types of businesses and opportunities.

Analysts pointed to M&A deals aimed at scooping up distressed assets as well as ancillary businesses that often require less money to operate than plant-touching companies such as cultivators and retailers.

On the flip side, these same plant-touching businesses will likely face more obstacles raising capital, according to analysts.

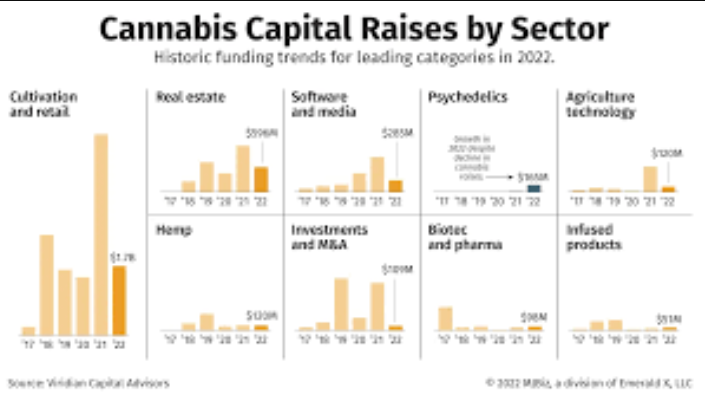

Last year, nearly every cannabis sector tracked by Viridian Capital Advisors – from M&A to cultivation to real estate – saw steep declines in capital raises compared to 2021’s capital markets boom, which was driven by sales growth, less expensive capital and hopes for federal reform.

Just biotech/pharma, infused products and extracts and psychedelics grew in 2022. (Viridian, a New York-based capital, M&A and strategic advisory firm, started tracking psychedelics as a counterpoint to cannabis.)

“The equity side of the capital markets just completely went away at the end of last year for U.S. cultivators,” Frank Colombo, director of data analytics at Viridian, told MJBizDaily.

“And for the first three weeks of 2023, we had no debt deals, which was really surprising to me because that was the thing that was holding the market up.”

That’s until Massachusetts-based multistate cannabis operator MariMed announced in January it had secured a $35 million credit facility from lenders Chicago Atlantic Advisors and Silver Spike Investment Corp.

“It was good news because it showed that even medium-sized companies can still get debt capital,” Colombo said.

High cost of capital

On the other hand, Colombo said, the terms of the deal also show how expensive capital is and how important it is for that capital to be allocated strategically.

MariMed will receive $30 million at close with the option to borrow another $5 million over the next six months.

The loan carries a floating interest rate of the prime rate plus 5.75%, with 30% warrant coverage.

“I come from a high-tech background, so it took me a while to get over what the price of lending is in cannabis,” MariMed Chief Financial Officer Susan Villare told MJBizDaily.

“Never in my career had I done debt financing over 10%.”

But when Villare looked at the rates other players were paying in refinancing deals, the fact that the SAFE Banking Act failed to pass Congress and what MariMed could achieve with the $35 million, she decided it was the right deal.

After listing on the Canadian Securities Exchange last July, MariMed announced its $20 million acquisition of Maryland medical cannabis business Kind Therapeutics.

The deal came shortly before Maryland voters overwhelmingly approved adult-use marijuana legalization last November.

MariMed also plans to expand operations in Illinois, Massachusetts and Missouri.

“We could certainly do it with cash flow from operations. But we said, ‘Hey, let’s accelerate that,’” Villare noted.

“We’ll do the secured financing to get that done. It’s pretty short term – three years – and we’re confident with cash flow from operations that we can pay it down, and we did negotiate hard to ensure that there would be no prepayment penalties should we pay it all down after 20 months.”

Growth opportunities

Both Colombo and Patrick Rea, the managing director at San Francisco-based venture capital firm Poseidon Garden Ventures, said they expect cultivators and cannabis license holders to pay a premium for capital and struggle to secure investment through 2023.

Even though software and media companies have been downsizing and, in the case of Denver-based Akerna Corp., exiting the industry entirely, non-plant-touching ancillary services are scalable, without the burden of licensing.

“I find a lot of the investors I spoke with are really just focusing on ancillary technology and taking a break from licensed operations because what we’ve learned about licensed operations is that they’re capital intensive. It takes a lot of money to get them up and going,” Rea told MJBizDaily.

“And when cannabis regulators and legislators realize that the sky didn’t fall and there’s no zombie apocalypse (after legalization), they issue more licenses. And every additional license they put out decreases the value of the existing licenses because there’s more competition.”

Colombo said more funds will likely be created with the purpose of raising money to invest in financially struggling operations and companies.

“We’ve both talked to people and heard secondhand of other groups trying to raise money to pursue acquisitions of distressed properties,” he said.

Similar to predictions that M&A would be dominated by acquisitions of distressed assets in 2023, capital raises will also go toward either distressed asset acquisitions or rescue financing for companies struggling to stay afloat.

Psychedelics

One area that is attracting investor dollars is the psychedelics business.

Viridian started tracking capital raises in psychedelics because the company was noticing the flood of capital going into the sector, Colombo said.

“So it’s an incredible counterpoint that shows businesses that have incredible growth potential like cannabis,” he said.

“And it’s further behind the curve in terms of development of actual revenues.”

“But it’s way, way ahead of the curve in terms of regulatory approval,” Colombo said, because some psychedelic drugs used in treatment clinics such as ketamine aren’t Schedule 1 drugs.

That means the sector is perceived as less risky, with lots of opportunity for capital raises and M&A.

“If you had asked me three or four years ago if psychedelics would be more legal than cannabis, I would have said, ‘What are you, crazy? You must be joking.’

“But that is indeed how it has transpired.”