Business

Does Canada’s shrinking medical cannabis market offer lessons for other nations?

Canada’s regulated medical cannabis market has dwindled significantly from its peak, declining well before recreational marijuana legalization in October 2018 and continuing that downward trend as adult-use sales displaced purchases through regulated medical channels.

Experts say factors behind the medical market’s decline include:

- The convenience of shopping at adult-use stores.

- Challenges for doctors in authorizing medical cannabis.

- A lack of tax advantages for medical cannabis clients and producers.

- THC potency limits that apply to both recreational and medical cannabis products.

Those issues might offer lessons for other nations and jurisdictions that legalize medical marijuana first, followed by adult-use legalization.

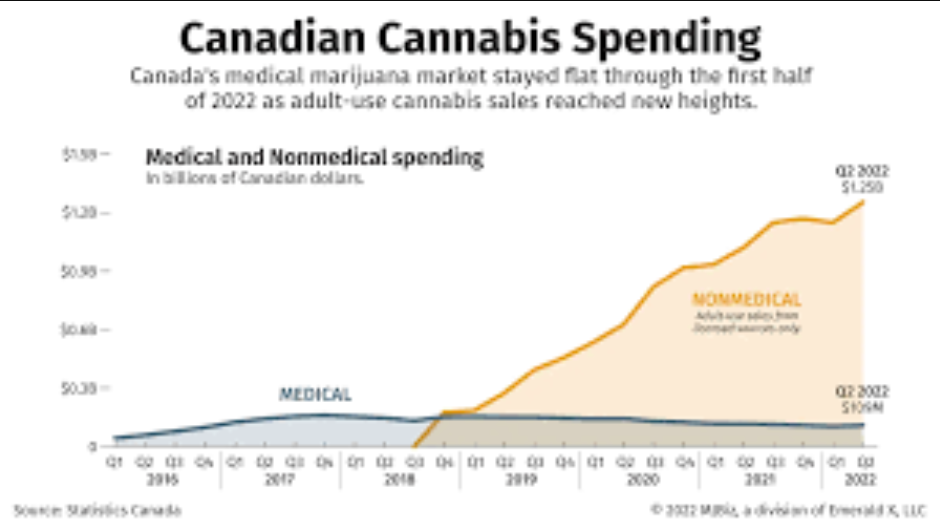

In Canada, spending on medical cannabis products peaked about a year before recreational cannabis sales began, reaching 161 million Canadian dollars ($120 million) in the fourth quarter of 2017, according to Statistics Canada data.

The most recent data shows medical marijuana sales totaled CA$109 million in the second quarter of 2022, after hitting a low of CA$104 million in the first quarter.

“Right now, what’s happening is the patients, they just give up and they just go buy something” from an adult-use store, said Brett Zettl president and CEO of Saskatoon, Saskatchewan-based medical cannabis company Zyus Life Sciences, which is preparing to go public via a reverse takeover.

“And so, they’re self-medicating without any medical oversight whatsoever.”

Canada was the first major global economy to legalize recreational cannabis at the federal level.

However, mature marijuana markets in the United States such as Colorado have exhibited a similar dynamic, with medical markets shrinking after recreational legalization.

Those trends raise the question of whether a similar medical market decline could occur in Germany, Europe’s biggest cannabis market, if that country follows through on its adult-use legalization plan.

Some Germans pay out-of-pocket for medical cannabis, and that subset of the market stands to be affected by adult-use legalization, said Deepak Anand, a board member of nonprofit advocacy group Medical Cannabis Canada and a consultant on marijuana regulations for several international governments.

However, Anand said roughly 40% of all German medical cannabis prescriptions are reimbursed by the public health system.

“I don’t think that the trajectory that we’ve seen in legal markets where, basically, post-(recreational) legalization we see medical sales have declined, will necessarily continue in Germany,” Anand said.

‘The hassle factor’

Canadians wishing to access medical marijuana products such as dried cannabis, edibles, oils or topicals through the government’s system require an authorization by a physician or nurse practitioner, allowing them to buy cannabis directly from licensed producers for mail delivery.

Home medical cannabis cultivation is also permitted, as is sourcing supply from a designated grower.

Only about 42,000 individuals produced medical cannabis for themselves or others as of the end of 2021, according to Health Canada.

In comparison, there were roughly 257,000 registrations to buy cannabis from a commercial producer (individuals can register with more than one producer).

Several factors might explain why the Canadian medical marijuana market has declined from its 2017 peak, according to Zettl, a longtime presence in Canada’s regulated MMJ industry.

Ahead of recreational legalization in October 2018, Zettl said, Canada’s medical cannabis patient population included both “true medical users” and some recreational users.

“They would try to get it legitimately and then still use it recreationally,” Zettl explained.

Now, he said, using the formal medical marijuana stream has become inconvenient compared to buying cannabis at an adult-use store.

Zettl also believes doctors might not want to spend time filling out medical cannabis authorization paperwork and that physicians who authorize cannabis for too many patients could face unwanted audits by medical-certification bodies.

“People just don’t want the hassle factor,” Zettl said. “The doctors don’t want the hassle factor.”

Other medical marijuana challenges

Cannabis consultant Anand cited some other factors contributing to the Canadian MMJ market’s decline.

“Pre-(recreational) legalization, there were a number of challenges with respect to form factors,” Anand said.

New forms of cannabis, including edibles, hit the market after adult-use legalization, but medical marijuana products are subject to the same regulations as recreational cannabis – including THC limits on products such as edibles.

Holding “medical and recreational cannabis to the same standards, with respect to putting on limits for high THC, for example, that is a mistake,” Anand said.

He believes Canada has been so focused on recreational legalization that “not only have patients been ignored, but also regulatory policy has been ignored to a large extent.”

“And what we saw, and what we’re seeing is, patients are going to the legacy or the illicit market to be able to access their products,” he continued.

The affordability of cannabis was another historical challenge for the medical market, Anand added.

“Obviously, we’ve seen that improve post-(recreational) legalization.”

Canada offers little in the way of preferential tax treatment for registered medical cannabis clients, although it does permit registered patients to claim medical marijuana expenses on their annual tax returns.

Patients pay retail taxes on medical marijuana purchases, as they would at a recreational store, and producers pay the same excise taxes as they do for adult-use cannabis.

That “just doesn’t make sense,” Anand said.

“We don’t charge tax on any other pharmaceutical products in Canada.”

Finding growth again

Anand called for policy changes to get Canada’s medical marijuana market growing again.

“Allowing pharmacies to be able to dispense medical cannabis is a no-brainer – that should be immediate,” he said.

“Eliminating tax should be another immediate step that we want to take, and eliminating potency limits.”

Canada’s federal Cannabis Act is currently under review, and the Canadian cannabis industry is hoping for reforms.

The government lists the “impact of legalization and regulation of cannabis on access to cannabis for medical purposes” as one of its “key themes” for the review.

Zyus’ Zettl said the government is using “this recreational-style act to oversee and regulate the medical side – and it’s basically coming at a massive disservice for the medical usage, both on the doctor side and the patient side.”

In terms of finding growth in Canada’s medical marijuana market, Zettl said Zyus is developing three cannabis drug-product candidates and hopes to eventually receive formal Drug Identification Numbers (DINs) from Health Canada.

He said such products could “become the holy grail,” because they could be included in insurance company prescription-drug formularies and doctors could prescribe them without worrying about scrutiny from their regulators.

Zettl acknowledged that achieving DINs for herbal cannabis products is a long-term goal.

“So medical cannabis in the meantime, though, has to find ways to appeal to the individuals who are really, truly using it medically and provide some kind of reason for them not to just give up and start just buying (from recreational stores).”