Business

‘Croptober’ pushes Canada’s cannabis inventories to record 1.4 billion grams

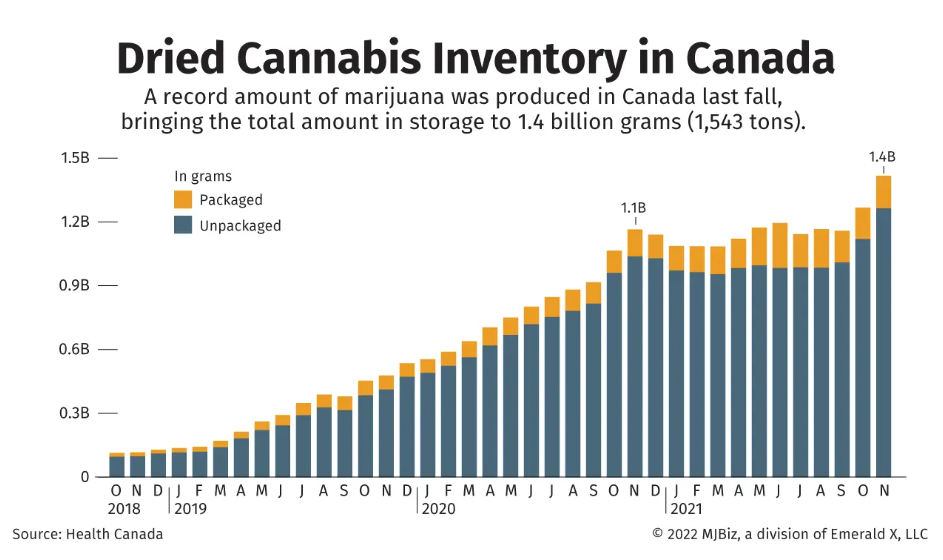

Canadian cannabis cultivators produced a record amount of marijuana during last fall’s “croptober” – when most of the outdoor harvest comes in – despite falling retail prices and already-bulging inventories.

Cannabis produced in September, October and November 2021 totaled 561,459 kilograms – or about 560 tons – of dried cannabis, bringing the total amount stored by licensed producers, wholesalers and retailers to 1.4 billion grams (roughly 1,543 tons) as of the end of November, according to new Health Canada data.

The data suggests Canada’s cannabis industry still suffers from a serious supply-demand imbalance, even after major greenhouse closures and insolvencies.

Last year, prices declined for every cannabis product category, partly because of overproduction.

Among the 1.4 billion grams of dried cannabis in inventory are 1.26 billion grams of unpackaged flower.

Most of that product is thought to be unsellable for various reasons, including poor quality or low THC scores.

New production in 2021 totaled at least 1.6 billion grams, a figure that continues to rise as more companies enter the cannabis industry than leave the sector.

“Despite significant M&A activity and consolidation within the group, flower sales are becoming more dispersed as a result of more companies competing in the flower category,” Pablo Zuanic, an analyst with New York-based investment banking firm Cantor Fitzgerald, wrote in a recent note to investors.

Zuanic noted that more companies than ever are competing in the dried-flower category, which accounts for about three-quarters of cannabis sales in Canada.

In the second quarter of this year, 126 companies were competing in the category, up sharply from 87 in the second quarter of 2021 and 53 in 2020, the analyst wrote.

Consolidation and restructurings have barely slowed the number of new companies entering the ultracompetitive market.

As of July, there were 886 licensed cultivators, processors and sellers under Canada’s Cannabis Act.

One year ago, there were 730.

In 2020 and 2019, the numbers were approximately 440 and 206, respectively.

Improved efficiencies

In addition to more producers, Bill MacDonald, professor and coordinator of Niagara College’s Commercial Cannabis Production program, suggested inventories might still be rising because licensed producers are getting better at growing marijuana at scale after struggling in the early years following the launch of the country’s adult-use market in 2018.

“What I think is happening is the ones that are producing are getting a handle on how to produce, and they’re getting higher yields,” he said.

“So even though you close down a bunch (of greenhouses), the ones that are remaining are learning from their mistakes, they’re getting better growing techniques.”

MacDonald expects to see more closures in the coming months and years.

“There’s just so much (inventory) out there,” he said.

MacDonald said the overproduction by large producers threatens the survivability of small and midsize growers.

“The smaller players are producing great product,” he said, “but it’s hard to compete when prices have been pushed so far down due to the large inventories. I hope the micros can hang on.”

More licensed space

Canada had more licensed outdoor growing area than ever last year, but industry sources expect to see a rightsizing as the economics for outdoor production become less and less appealing.

According to Health Canada’s latest data, licensed outdoor growing area rose to a record-high 713 hectares, or 76,746,681 square feet, as of the end of 2021.

“What we’re going to see this year is a reduction in the amount of harvests around ‘croptober,’ because some people have definitely pulled back and they’re recognizing that market sales have not been great enough,” said Av Singh, cultivation expert at Nova Scotia-based Flemming & Singh Cannabis.

“We just don’t need to produce as much outdoors as certain folks were doing.”

Federally licensed indoor and greenhouse growing area for marijuana, by contrast, fell to 18,908,337 square feet, which is 21% lower than the all-time high reached in mid-2020 of 23,865,914 square feet.

However, that is also thought to be too much space to accommodate a market the size of Canada’s.

The overproduction is continuing to an ever increasing amount of product that must be destroyed because it can’t be sold.

Canada’s federally regulated producers destroyed 425 million grams – or 468 tons – of unsold, unpackaged dried cannabis last year. That compares with 279 million grams of destroyed product in 2020 and 155 million grams in 2019.

Additionally, more than 7 million packages of adult-use marijuana were sent for destruction across the country in 2021.

Singh said the industry’s stewards of capital are still broadly misallocating resources, resulting in the country producing way more cannabis than it needs.

“The bias is still around poorer quality product,” he said.

Extract price pressure

Singh said most of the outdoor production that doesn’t go straight into semipermanent storage goes into extract products such as vape pens.

He said a comparatively small number of growers are producing outdoors for the dried-flower market.

That could mean the impact from the recent “croptober” overproduction on the overall dried-flower market will be muted.

Where prices could see further downward pressure is in the extracts category, especially vape products.

“Sellable flower should be happening from product produced in greenhouses and indoor, so the huge amount of new (largely outdoor) inventory should not influence sellable flower (prices),” Singh said.

He said companies producing extracts with more expensive inputs from indoor and greenhouse material would be at a competitive disadvantage compared to companies using more abundant, and cheaper, outdoor cannabis for their extracts.

Source: https://mjbizdaily.com/croptober-pushes-canadas-cannabis-inventories-to-record-1-4-billion-grams/