Business

Cannabis MSO earnings resilient through third quarter of 2022

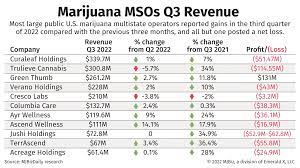

U.S. cannabis multistate operators weathered a storm of challenging economic factors through the third quarter of 2022, with most reporting modest to significant year-over-year revenue gains.

But only Chicago-based Green Thumb Industries reported a profit for that quarter, at $131 million.

That’s a 506% increase from a year ago, when Green Thumb reported a $21.6 million profit for the same period.

In a Nov. 14 newsletter, Frank Colombo, director of data analytics at New York-based Viridian Capital Advisors, attributed the industry’s challenges to:

- Price compression, which is affecting wholesale prices for flower and other products in more mature state markets.

- Inflation, which is eroding consumers’ buying power and increasing the cost of doing business.

- Delays to New York’s long-awaited adult-use cannabis market launch, which could be worth as much as $1 billion in its first year, according to the 2022 MJBiz Factbook.

- Ongoing difficulties in California’s regulated market, where legal operators are struggling with high taxes and a robust illicit market.

“Moreover, a true test of the recession/inflation resistance of the industry is at hand,” Colombo wrote.

“Already, basket sizes have been coming down in multiple markets as pressured consumers trade down to lower priced products.”

Still, Colombo noted, there’s a lot to look forward to in 2023.

“New Jersey has been a resounding success, and two big markets, Maryland and Missouri, legalized in the midterm election,” he wrote.

“Illinois sales are up 16% year-over-year ahead of new licenses coming online, and New York may yet get its act together.”

New Jersey reaps rewards

Indeed, the seven cannabis multistate operators that gained access to New Jersey’s new adult-use market, which launched in April, experienced revenue boosts.

They include Acreage Holdings, Ascend Wellness Holdings, Columbia Care, Curaleaf Holdings, Green Thumb, TerrAscend Corp. and Verano Holdings.

Massachusetts-based Curaleaf ranked highest in revenue for the quarter, at $339.7 million – a 7% year-over-year gain and a 1% sequential increase from the previous quarter – as it closed its acquisition of Tryke and its majority stake acquisition of Four20 Pharma.

New York-based Ascend Wellness reported strong results, despite an executive shuffle that sent one of co-founders and former CEO Abner Kurtin to the executive chair role after he was charged with battery last fall. The charge was later dropped.

In a Nov. 11 note to clients, Matt Bottomley, an analyst for Toronto-based Canacord Genuity, attributed the company’s 14% sequential revenue increase and 19.9% year-over-year increase to third-party wholesale sales, transitioning medical marijuana dispensaries to adult-use stores and new retail locations.

“Retail sales increased 9.6% quarter over quarter to $82.8 million, while net wholesale revenue grew 29.6% sequentially to $28.4 million, primarily driven by higher third-party sales in Illinois, New Jersey and Massachusetts,” he wrote.

New Jersey’s adult-use sales are expected to total about $2 billion by 2025, according to the 2022 MJBiz Factbook.

Hurricane Ian, other headwinds

Florida-based Trulieve Cannabis lost $114 million in the third quarter of 2022 but still had 34% year-over-year growth, reporting more than $300 million in revenue.

Th company’s retail revenue decreased 5% sequentially, which the company attributed to the impacts of Hurricane Ian and lower net patient growth in its Florida medical marijuana market.

Arizona revenue declined because of increased pressure on retail prices and lower traffic coming into stores, according to Trulieve’s third-quarter investor presentation. But Pennsylvania revenue increased.

“As the company’s 750,000 square-foot Jefferson Park facility continues to ramp in mid-2023, we believe this will provide Trulieve with a meaningful cost and margin advantage versus its competitors,” Bottomley wrote, referring to Trulieve’s new indoor cultivation facility.

“Trulieve commented that given the macroeconomic headwinds, challenging consumer spending environment, increased promotional activity expected around the holiday season, and the impact from Hurricane Ian and Tropical Storm Nicole, it now believes it will achieve the low end of its full-year 2022 guidance of $1.25 (billion) to $1.3 billion in revenue and $415 (million) to $450 million in adjusted EBITDA.”

Chicago-headquartered Cresco Labs reported mixed results with $210 million in revenue for the quarter, a 2% decrease year-over-year and a 3.8% decline from the previous quarter.

“The decline was primarily attributable to ongoing price compression and increased competition on the wholesale front, which resulted in wholesale revenues declining approximately 2% sequentially from Q2/2022 to $93 million,” Canaccord Genuity analyst Derek Dley wrote in a Nov. 15 note to clients.

Analysts remain confident that Cresco’s acquisition of New York-based Columbia Care, which requires the divestiture of assets in Maryland and Ohio as well as a Florida license, is on track.

The deal also rests on approval from New York regulators of Sean ‘Diddy’ Combs’ acquisition of the companies’ retail and marijuana production assets in a deal valued up to $185 million.

“We think this meaningfully increases the probability that Cresco’s deal to acquire Columbia Care will close with no modifications,” Pablo Zuanic, managing director of New York-based equity analysis firm Cantor Fitzgerald, wrote in a Nov. 28 email to clients.

For its part, Columbia Care reported $132.7 million in revenue, a 2.4% sequential increase and a .3% increase year-over-year.

“Although the company continues to anticipate a challenging operating environment over the next 12-18 months, management is encouraged by the ongoing resilience it has seen throughout its markets.”

Source: https://420-reports.com/wp-admin/post.php?post=5634&action=edit