Business

Unique Challenges in Cannabis Patent Valuation

Patents are increasingly a significant proportion of a cannabis company’s claimed valuation. As cannabis companies identify ways to differentiate their business from competitors, patents play an important role in ensuring that competitors cannot duplicate their products or processes.

Patents are often used to insulate products from direct competition by building temporary barriers to prevent competitors from using the same advantages. Companies can also build portfolios of patented technology that can be sold or licensed like any other asset, or used to enhance their valuation for acquisition or investment.

Not all patents, however, are created equal. Patents are supposed to be issued only for new and useful inventions, but many conflicts and self-sabotaging policies are built into the patent system that frequently result in “bad” patents–in all fields of technology–that would be invalidated if ever enforced. These patents look like all others at first glance, but they have no practical value. On the other hand, highly defensible patents may be practically worthless because they have no commercial applicability.

Involving a patent attorney who is familiar with the industry’s technology can significantly increase your ability to evaluate the worth of a patent or portfolio.

When reading and evaluating the value of a patent, whether in cannabis or any other field, there are four main considerations:

1) What do the patents actually cover?

Evaluating a patent’s scope of coverage is a two-step process. Step one is to determine what products or processes are covered by the specific language of the patent claims. Patents are technically dense documents that often seem much broader than they really are.

The idiosyncratic language and nuanced technicalities of patent law make patents difficult to understand for non-patent professionals, even experienced lawyers or scientists. Seemingly minute changes in language (i.e., “comprising” vs. “consisting of”) can have enormous consequences on what technologies are covered by the patent.

The second step of patent interpretation is to identify any “hidden” limitations on the patent’s scope. Frequently, and for a variety of reasons, a patent’s actual coverage may be significantly narrower than the explicit words of the patent. This typically results from the applicant making arguments or amendments during the lengthy application process.

The patent application process often lasts several years and involves dozens of communications between the applicant and the patent office. Applicants often make arguments to distinguish their invention from previous inventions in the hopes of convincing the patent office to grant them a patent. Under certain circumstances, those arguments can dedicate some aspects of the invention to the public and later be used against the patentee if they try to assert their patent rights.

Determining the patented subject matter is a critical step in valuing any patent and cannabis patents are no exception.

2) Is the patented technology valuable to the industry?

Not every patent is valuable. The application and examination process is supposed to ensure that patents are awarded only for “new” and “useful” inventions, but there is no requirement that the invention be commercially viable.

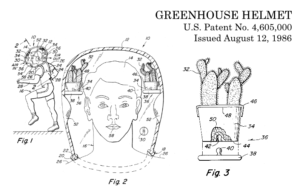

Patents may issue that have no practical value because no company is interested in making or using that technology, as in the often cited useless patent below, the Greenhouse Helmet. Or, even worse, they may be able to achieve the same (or better) results by simply making minor changes that avoid the patent claims altogether. The ease with which a competitor can “design around” patents and achieve similar results will greatly reduce the value of a patent.

It is not always easy to evaluate how valuable a particular invention is to an industry. One of the best indicators is the current commercialization of the invention. If the patentee and their biggest competitors are all using the patented technology, that is a strong indication that the technology has commercial value. On the other hand, if commercial realities or consumer preferences have limited the patented technology’s adoption, the patent may be practically worthless.

In the cannabis industry, technology is changing rapidly. There are often many different paths to the same destination. Whether a patented new method, composition, formulation, or device has any commercial value is a matter of whether the technology provides substantial reduction in production costs or increase in consumer demand. Proper valuation of cannabis patents therefore requires deep technical understanding of the cannabis supply chain.

3) Do major validity threats exist?

The biggest threat to any patent in any field is prior art. Prior art refers to any printed publication (typically patents and academic papers) or use of an invention before the patent’s filing date. Patented inventions are supposed to be “novel” and “nonobvious,” meaning that they represent a non-trivial advancement of public knowledge. Evidence that the invention was known or in public use prior to the application’s filing date (i.e., that it was prior art) can invalidate or limit the scope of a patent.

Identifying all potentially invalidating prior art, however, is difficult, if not impossible. High-stakes patent litigation will often uncover seemingly buried prior art, like the only copy of a doctoral thesis housed in a German library. Patent search companies can also look through commercial and proprietary databases to identify potentially relevant prior art, but that process can be expensive and is not guaranteed find all references.

Finding invalidating prior art is especially challenging in the cannabis industry, where federal prohibition has significantly limited traditional forms of prior art. In many cases, the inventions were used for years prior to filing but were not published in traditional sources. Examiners and search firms generally do not check future4200.com, Reddit, or dark web forums for cannabis prior art. To have any practical value, therefore, prior art searches for cannabis inventions must be carefully tailored to both the technology and industry segment.

4) Were critical patentability and ownership requirements met?

Aside from prior art, the biggest threats to a patent’s value are the technical requirements of the patent’s ownership and priority claims.

Ownership is perhaps the most obvious. In the U.S., patent rights belong to the inventors and are not automatically transferred to their employers. It is important to review assignment records to verify that the purported owner actually possesses those rights.

Patent priority is somewhat less intuitive than ownership, but it can have a big impact on a cannabis patent’s validity. Applicants can file multiple related applications on different aspects of the technology. Applications with an intact priority chain are entitled to the benefit as if they were filed on the earliest application date with the claimed subject matter. The earlier the priority date, the more likely the patent will withstand prior art challenges.

Failure to file the appropriate documents at the appropriate time can break the priority chain and result in a much later priority date. This is especially problematic in cannabis patents, where the bulk of prior art has been published in the last decade. Losing 1-2 years of priority could result in dozens of additional prior art references coming into play.

Takeaways

More and more patents covering cannabis technology issue every week. In all industries, but especially cannabis, it is vital to pair patent law expertise with technical understanding of the industry. The four questions above should be carefully considered in all situations where patent valuation is at issue.

Source: https://harrisbricken.com/cannalawblog/unique-challenges-in-cannabis-patent-valuation/

Business

New Mexico cannabis operator fined, loses license for alleged BioTrack fraud

New Mexico regulators fined a cannabis operator nearly $300,000 and revoked its license after the company allegedly created fake reports in the state’s traceability software.

The New Mexico Cannabis Control Division (CCD) accused marijuana manufacturer and retailer Golden Roots of 11 violations, according to Albuquerque Business First.

Golden Roots operates the The Cannabis Revolution Dispensary.

The majority of the violations are related to the Albuquerque company’s improper use of BioTrack, which has been New Mexico’s track-and-trace vendor since 2015.

The CCD alleges Golden Roots reported marijuana production only two months after it had received its vertically integrated license, according to Albuquerque Business First.

Because cannabis takes longer than two months to be cultivated, the CCD was suspicious of the report.

After inspecting the company’s premises, the CCD alleged Golden Roots reported cultivation, transportation and sales in BioTrack but wasn’t able to provide officers who inspected the site evidence that the operator was cultivating cannabis.

In April, the CCD revoked Golden Roots’ license and issued a $10,000 fine, according to the news outlet.

The company requested a hearing, which the regulator scheduled for Sept. 1.

At the hearing, the CCD testified that the company’s dried-cannabis weights in BioTrack were suspicious because they didn’t seem to accurately reflect how much weight marijuana loses as it dries.

Company employees also poorly accounted for why they were making adjustments in the system of up to 24 pounds of cannabis, making comments such as “bad” or “mistake” in the software, Albuquerque Business First reported.

Golden Roots was fined $298,972.05 – the amount regulators allege the company made selling products that weren’t properly accounted for in BioTrack.

The CCD has been cracking down on cannabis operators accused of selling products procured from out-of-state or not grown legally:

- Regulators alleged in August that Albuquerque dispensary Sawmill Sweet Leaf sold out-of-state products and didn’t have a license for extraction.

- Paradise Exotics Distro lost its license in July after regulators alleged the company sold products made in California.

Golden Roots was the first alleged rulebreaker in New Mexico to be asked to pay a large fine.

Source: https://mjbizdaily.com/new-mexico-cannabis-operator-fined-loses-license-for-alleged-biotrack-fraud/

Business

Marijuana companies suing US attorney general in federal prohibition challenge

Four marijuana companies, including a multistate operator, have filed a lawsuit against U.S. Attorney General Merrick Garland in which they allege the federal MJ prohibition under the Controlled Substances Act is no longer constitutional.

According to the complaint, filed Thursday in U.S. District Court in Massachusetts, retailer Canna Provisions, Treevit delivery service CEO Gyasi Sellers, cultivator Wiseacre Farm and MSO Verano Holdings Corp. are all harmed by “the federal government’s unconstitutional ban on cultivating, manufacturing, distributing, or possessing intrastate marijuana.”

Verano is headquartered in Chicago but has operations in Massachusetts; the other three operators are based in Massachusetts.

The lawsuit seeks a ruling that the “Controlled Substances Act is unconstitutional as applied to the intrastate cultivation, manufacture, possession, and distribution of marijuana pursuant to state law.”

The companies want the case to go before the U.S. Supreme Court.

They hired prominent law firm Boies Schiller Flexner to represent them.

The New York-based firm’s principal is David Boies, whose former clients include Microsoft, former presidential candidate Al Gore and Elizabeth Holmes’ disgraced startup Theranos.

Similar challenges to the federal Controlled Substances Act (CSA) have failed.

One such challenge led to a landmark Supreme Court decision in 2005.

In Gonzalez vs. Raich, the highest court in the United States ruled in a 6-3 decision that the commerce clause of the U.S. Constitution gave Congress the power to outlaw marijuana federally, even though state laws allow the cultivation and sale of cannabis.

In the 18 years since that ruling, 23 states and the District of Columbia have legalized adult-use marijuana and the federal government has allowed a multibillion-dollar cannabis industry to thrive.

Since both Congress and the U.S. Department of Justice, currently headed by Garland, have declined to intervene in state-licensed marijuana markets, the key facts that led to the Supreme Court’s 2005 ruling “no longer apply,” Boies said in a statement Thursday.

“The Supreme Court has since made clear that the federal government lacks the authority to regulate purely intrastate commerce,” Boies said.

“Moreover, the facts on which those precedents are based are no longer true.”

Verano President Darren Weiss said in a statement the company is “prepared to bring this case all the way to the Supreme Court in order to align federal law with how Congress has acted for years.”

While the Biden administration’s push to reschedule marijuana would help solve marijuana operators’ federal tax woes, neither rescheduling nor modest Congressional reforms such as the SAFER Banking Act “solve the fundamental issue,” Weiss added.

“The application of the CSA to lawful state-run cannabis business is an unconstitutional overreach on state sovereignty that has led to decades of harm, failed businesses, lost jobs, and unsafe working conditions.”

Business

Alabama to make another attempt Dec. 1 to award medical cannabis licenses

Alabama regulators are targeting Dec. 1 to award the first batch of medical cannabis business licenses after the agency’s first two attempts were scrapped because of scoring errors and litigation.

The first licenses will be awarded to individual cultivators, delivery providers, processors, dispensaries and state testing labs, according to the Alabama Medical Cannabis Commission (AMCC).

Then, on Dec. 12, the AMCC will award licenses for vertically integrated operations, a designation set primarily for multistate operators.

Licenses are expected to be handed out 28 days after they have been awarded, so MMJ production could begin in early January, according to the Alabama Daily News.

That means MMJ products could be available for patients around early March, an AMCC spokesperson told the media outlet.

Regulators initially awarded 21 business licenses in June, only to void them after applicants alleged inconsistencies with how the applications were scored.

Then, in August, the state awarded 24 different licenses – 19 went to June recipients – only to reverse themselves again and scratch those licenses after spurned applicants filed lawsuits.

A state judge dismissed a lawsuit filed by Chicago-based MSO Verano Holdings Corp., but another lawsuit is pending.

Source: https://mjbizdaily.com/alabama-plans-to-award-medical-cannabis-licenses-dec-1/

-

Business2 years ago

Business2 years agoPot Odor Does Not Justify Probable Cause for Vehicle Searches, Minnesota Court Affirms

-

Business2 years ago

Business2 years agoNew Mexico cannabis operator fined, loses license for alleged BioTrack fraud

-

Business2 years ago

Business2 years agoAlabama to make another attempt Dec. 1 to award medical cannabis licenses

-

Business2 years ago

Business2 years agoWashington State Pays Out $9.4 Million in Refunds Relating to Drug Convictions

-

Business2 years ago

Business2 years agoMarijuana companies suing US attorney general in federal prohibition challenge

-

Business2 years ago

Business2 years agoLegal Marijuana Handed A Nothing Burger From NY State

-

Business2 years ago

Business2 years agoCan Cannabis Help Seasonal Depression

-

Blogs2 years ago

Blogs2 years agoCannabis Art Is Flourishing On Etsy