Business

Midyear state cannabis sales a mixed bag across the United States

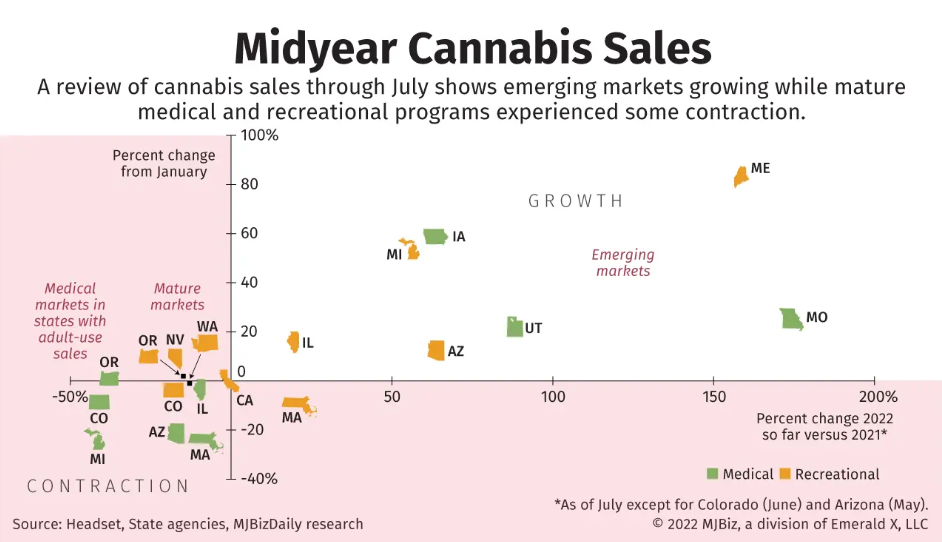

U.S. cannabis sales through July were a mixed bag across the country, as consumers adjusted to historic inflation and shrinking disposable income, according to an analysis of state sales data by MJBizDaily.

Newer recreational and medical markets posted the kind of double-digit growth expected from emerging cannabis markets.

During the first seven months of the year, for example, Maine’s recreational market and Missouri’s medical program almost tripled their sales compared to the same period in 2021.

Markets experiencing growth through the first seven months of this year include:

- Missouri (medical): 174%.

- Maine (recreational): 159%.

- Utah (medical): 87%.

- Arizona (recreational sales through May): 64%.

- Iowa (medical): 63%.

- Michigan (recreational): 57%.

- Illinois (recreational): 20%.

By contrast, more mature adult-use markets in California, Colorado and Oregon contracted, some declining 20% or more compared to the first six months of 2021.

Mature medical programs in states now offering adult-use cannabis – such as Arizona, Oregon and Colorado – continue to experience declining sales as patients shift from the doctor’s office to the recreational retail counter.

Colorado medical sales, for example, have resumed their decline after a brief rebound during the initial outbreak of the COVID-19 pandemic in the first half of 2020.

Medical cannabis sales in the state shrank 43% in the first six months of this year versus the same period in 2021.

Medical markets that posted falling sales during the first of the year compared to the same period last year include:

- Colorado: -42.8%.

- Michigan: -41.3%.

- Oregon: -37.7%.

- Arizona: -16.5%.

- Massachusetts: -10.3%.

- Illinois -10.4%.

While each state is a unique cannabis economy subject to varying governmental oversight and seasonal changes, including summer and winter tourism, some consistent themes emerged in early 2022.

Accelerating inflation eroded cannabis buyers’ disposable income, forcing shoppers to pick and choose among products based on price.

Cannabis sales have experienced this kind of sensitivity to disposable income before, only in reverse.

Pandemic stimulus checks starting in 2020 helped to bolster cannabis industry sales to historic gains through 2021 in most states.

These days, however, consumers are confronting rising prices for a broad range of goods and services.

The U.S Bureau of Labor Statistics reported earlier this month that its consumer price index for July jumped 8.5% from the same month a year ago – a slowdown from 9.1% in June.

Unlike other sectors of the economy, such as food, auto insurance and electricity, inflation is not directly impacting cannabis prices – yet.

Wholesale and retail marijuana prices continue to fall in most states, with production often outpacing consumption.

Despite having envious sales growth in the first half of the year, Michigan wholesale recreational marijuana prices have dropped below $1,000 or less a pound after many cultivation businesses came online.

The glut of cannabis products and brands have retailers in many states increasingly discounting their merchandise in hopes of shrinking bulging inventories and boosting sales amid growing competition.

It’s hard to know whether these issues will be resolved before year-end.

Economic pressures – along with a supply-and-demand tussle – could make for an overall down year in terms of sales.

Source: https://mjbizdaily.com/midyear-state-cannabis-sales-a-mixed-bag-across-the-us/