Business

Big Pharma Loses Billions With Each State That Legalizes Weed, So What Is Their Next Move?

To think that Pharma doesn’t have a strategy against a plant that is costing them upwards to $10 billion of lost potential revenue is to be ignorant of the ways of Pharma.

Want to know why historically Big Pharma sat in opposition of cannabis legalization? Well, if the findings of the latest study published in the journal PLOS ONE, their loss of revenue per legalization event could be a great indicator.

Per Marijuana Moment: “The peer-reviewed research article, published in the journal PLOS ONE on Wednesday, looked at stock return and prescription drug sales data for 556 pharmaceutical companies from 1996 to 2019, analyzing market trends before and after the enactment of medical and adult-use cannabis legalization laws at the state level.

“The stock returns were ‘1.5-2% lower at 10 days after legalization,’ the study authors founds. “Returns decreased in response to both medical and recreational legalization, for both generic and brand drugmakers. Investors anticipate a single legalization event to reduce drugmaker annual sales by $3 billion on average.”

While there has been several reports that cannabis patients prefer cannabis over their prescription meds, this study definitely shows the negative impact on Pharma ROI post legalization. However, it’s not just brand name pharmaceuticals that are taking a hit. It seems that cannabis is supplanting a lot of other generic brands as well.

Researchers at the California Polytechnic State University and University of New Mexico commented:

“By expanding access and, thus use, legalization could permit cannabis to compete with conventional pharmaceuticals. Largely unpatentable, cannabis may act like a new generic entrant following medical legalization, leading some individuals to substitute away from other drugs toward cannabis. However, unlike a conventional new generic drug, cannabis use is not restricted to a single or limited set of conditions. This means that cannabis acts as a new entrant across many different drug markets simultaneously.”

Now, for some, the notion of 1.5-2% doesn’t seem like much, but on Pharma scale profits it is quite significant as the study authors related, “We find the average change in a firm’s market value per legalization event is $63 million with a total impact on market value across firms per event of $9.8 billion.”

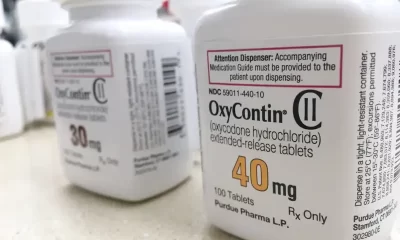

With that much money being sucked up by cannabis, it’s no wonder that the pharmaceutical companies were hesitant towards legalizing weed. While some pharmaceutical companies are investing in creating cannabis based medicines, it’s the opioid manufacturers that are losing the most.

Not True Losses

If you look at the profits of Pharma post legalization, they still continued to make money despite legalization. However, what researchers have noticed is that the “projections” made by Pharma weren’t met. This is one of the major differences that they found, however, this isn’t to say that there was an actual loss of revenue.

According to Marijuana Moment:

“The study also factored in shifts in pharmaceutical drug sales post-legalization. “Using the historical price-to-sales ratio of drugmakers for the year associated with each legalization event, this implies a change in annual sales across all drugmakers of $3 billion per event,” it says.”

Yet, it’s also important that we don’t jump the gun and cite all of this as fact as the study authors themselves admitted.

“The economic significance of an estimated $9.8 billion loss in market value across firms per cannabis legalization event is extremely large, however our results should be interpreted cautiously. A key limitation is that we model investors as rational, which may overstate the economic significance of our results. Second, we are limited to publicly traded firms and past legalization events. Third, we note that estimates may be sensitive to our choice of using 150 to 50 days before the legalization event. Finally, we expect there to be measurement error due to heterogeneity in the legalization and subsequent regulatory processes.

“For private and public drugmakers, we expect the response to legalization to include investment and marketing,” the study concludes, citing the fact that Pfizer spent billions to acquire a “biotech company that focuses on cannabinoid-type therapies.

“’Pharmaceutical firms have devoted substantial lobbying efforts and dollars into fighting cannabis legalization,’ it continues. ‘These are signs that the pharmaceutical industry from a marketing perspective, cannabis currently remains far from an [Food and Drug Administration]-approved therapeutic equivalent, and this might explain why pharmaceutical firms have spent less effort on detailing visits to doctors.’

“’Looking beyond effects for different stakeholder populations, our study suggests cannabis might be a useful tool for increasing competition in U.S. drug markets,’ the authors said.”

It’s important to note that these pharmaceutical companies remain opposed mainly because they cannot patent cannabinoids. Since cannabis is a very simple plant to grow at home, they don’t want it legal on a federal level. Imagine if anyone could grow their own mild-pain relievers, appetite stimulators, mood enhancers, with a little bit of sunshine and dirt?

This is something that Pharma had imagined — and they didn’t like it.

The Reason for Federal Stalling?

While the Democrats and Republicans bicker over whether inclusivity clauses should be added to cannabis legalization, I cannot help thinking that the “sponsors of politicians” might not have some influence over how people are voting. After all, nearly 70% of the US population favors cannabis legalization, yet despite this super majority, cannabis remains illegal on a federal level.

Now if we take a look at the people who take money from Pharma or who hold stock in Pharma and are currently in office, we might be able to paint a picture.

Of course, there is hardly any direct paper trails showcasing Big Pharma’s opposition — save donating to anti-cannabis organizations. However, we don’t need evidence to understand the nature of Pharma.

You see, Pharma plays the market like a game of chess and the pieces are your representatives.

Watch how Pharma spends their money when it comes to voting on key regulatory issues that would affect their bottomline.

According to KHN.ORG:

“Pharmaceutical companies and their lobbying groups gave roughly $1.6 million to lawmakers during the first six months of 2021, with Republicans accepting $785,000 and Democrats $776,200, the Pharma Cash to Congress database shows. Since the 2008 cycle, the industry has generally favored Republicans. The exception was 2009-10, the last time Democrats controlled both chambers of Congress and the White House.

“Democrats again narrowly hold both the House and Senate, and political scientists and other money-in-politics experts said the contributions likely reflect who is in power, which lawmakers face tougher reelection bids next year, and who has outsize sway over legislation affecting the industry’s bottom line.

“Several pharmaceutical companies paused contributions to Republican lawmakers who voted against certifying the results of the 2020 election, blunting the GOP’s total fundraising haul and overall industry giving compared with other years.”

As you can see, their money influences politics. This is nothing new, and if they are doing this so blatantly with Medicare regulations, what makes you think they don’t have any sway when it comes to cannabis legalization.

Of course, at this point it’s just “hearsay,” but considering the nature of Big Pharma, it wouldn’t surprise me if in the next 5 years we find actual evidence of them tampering with cannabis legalization, especially if people are more hesitant to use pharmaceuticals if cannabis is an alternative to treating the symptoms of their conditions.

To think that Pharma doesn’t have a strategy against a plant that is costing them upwards to $10 billion of lost potential revenue is to be ignorant of the ways of Pharma.

KHN.ORG goes on to report:

The drug industry’s campaign contributions are markedly strategic, said Steven Billet, an associate professor at the Graduate School of Political Management at George Washington University.

“This is a really well-organized commercial sector,” Billet said. “If I’m one of these PACs, I’ve surveyed the landscape at the front end of the process, decided on our agenda and budget, and figured out who I may be able to get to and who I wouldn’t be able to get to.”

Does this sound like bribery to you? It sure sounds like that to me, but of course, when politicians accept money from private companies who are supposed to be regulated by these very politicians we call it lobbying.

Bottom Line

Cannabis legalization directly affects Pharma’s bottom line. Pharma pays politicians to “vote” the way they want to vote. In other words, they use money to buy representation that is supposed to represent you, but instead represents primarily the needs of their donors. In this case, Pharma.

Despite the US having a super majority in favor of ending the war on cannabis, we still have the Federal government stalling at every opportunity they have. Some might say that it’s “The Republicans”, but as we saw, both sides are taking money at roughly equal sizes. The politicians running the show have a higher likelihood of being bribed by Pharma.

And even though the Democrats have been “complaining” that the only reason weed is illegal is because of Republican opposition, we’re seeing that after two years of Dems holding majority of the power — IT’S STILL NOT LEGAL!

In fact, Biden and his admin had done some pretty insane actions against the cannabis community like firing staffers over past cannabis use, calling cannabis users “untrustworthy and unethical and dangerous” and dodging any question about “keeping their promises”.

Could this be because their Pharma masters are telling them to behave like this? Who knows, but it certainly smells like it.

Business

New Mexico cannabis operator fined, loses license for alleged BioTrack fraud

New Mexico regulators fined a cannabis operator nearly $300,000 and revoked its license after the company allegedly created fake reports in the state’s traceability software.

The New Mexico Cannabis Control Division (CCD) accused marijuana manufacturer and retailer Golden Roots of 11 violations, according to Albuquerque Business First.

Golden Roots operates the The Cannabis Revolution Dispensary.

The majority of the violations are related to the Albuquerque company’s improper use of BioTrack, which has been New Mexico’s track-and-trace vendor since 2015.

The CCD alleges Golden Roots reported marijuana production only two months after it had received its vertically integrated license, according to Albuquerque Business First.

Because cannabis takes longer than two months to be cultivated, the CCD was suspicious of the report.

After inspecting the company’s premises, the CCD alleged Golden Roots reported cultivation, transportation and sales in BioTrack but wasn’t able to provide officers who inspected the site evidence that the operator was cultivating cannabis.

In April, the CCD revoked Golden Roots’ license and issued a $10,000 fine, according to the news outlet.

The company requested a hearing, which the regulator scheduled for Sept. 1.

At the hearing, the CCD testified that the company’s dried-cannabis weights in BioTrack were suspicious because they didn’t seem to accurately reflect how much weight marijuana loses as it dries.

Company employees also poorly accounted for why they were making adjustments in the system of up to 24 pounds of cannabis, making comments such as “bad” or “mistake” in the software, Albuquerque Business First reported.

Golden Roots was fined $298,972.05 – the amount regulators allege the company made selling products that weren’t properly accounted for in BioTrack.

The CCD has been cracking down on cannabis operators accused of selling products procured from out-of-state or not grown legally:

- Regulators alleged in August that Albuquerque dispensary Sawmill Sweet Leaf sold out-of-state products and didn’t have a license for extraction.

- Paradise Exotics Distro lost its license in July after regulators alleged the company sold products made in California.

Golden Roots was the first alleged rulebreaker in New Mexico to be asked to pay a large fine.

Source: https://mjbizdaily.com/new-mexico-cannabis-operator-fined-loses-license-for-alleged-biotrack-fraud/

Business

Marijuana companies suing US attorney general in federal prohibition challenge

Four marijuana companies, including a multistate operator, have filed a lawsuit against U.S. Attorney General Merrick Garland in which they allege the federal MJ prohibition under the Controlled Substances Act is no longer constitutional.

According to the complaint, filed Thursday in U.S. District Court in Massachusetts, retailer Canna Provisions, Treevit delivery service CEO Gyasi Sellers, cultivator Wiseacre Farm and MSO Verano Holdings Corp. are all harmed by “the federal government’s unconstitutional ban on cultivating, manufacturing, distributing, or possessing intrastate marijuana.”

Verano is headquartered in Chicago but has operations in Massachusetts; the other three operators are based in Massachusetts.

The lawsuit seeks a ruling that the “Controlled Substances Act is unconstitutional as applied to the intrastate cultivation, manufacture, possession, and distribution of marijuana pursuant to state law.”

The companies want the case to go before the U.S. Supreme Court.

They hired prominent law firm Boies Schiller Flexner to represent them.

The New York-based firm’s principal is David Boies, whose former clients include Microsoft, former presidential candidate Al Gore and Elizabeth Holmes’ disgraced startup Theranos.

Similar challenges to the federal Controlled Substances Act (CSA) have failed.

One such challenge led to a landmark Supreme Court decision in 2005.

In Gonzalez vs. Raich, the highest court in the United States ruled in a 6-3 decision that the commerce clause of the U.S. Constitution gave Congress the power to outlaw marijuana federally, even though state laws allow the cultivation and sale of cannabis.

In the 18 years since that ruling, 23 states and the District of Columbia have legalized adult-use marijuana and the federal government has allowed a multibillion-dollar cannabis industry to thrive.

Since both Congress and the U.S. Department of Justice, currently headed by Garland, have declined to intervene in state-licensed marijuana markets, the key facts that led to the Supreme Court’s 2005 ruling “no longer apply,” Boies said in a statement Thursday.

“The Supreme Court has since made clear that the federal government lacks the authority to regulate purely intrastate commerce,” Boies said.

“Moreover, the facts on which those precedents are based are no longer true.”

Verano President Darren Weiss said in a statement the company is “prepared to bring this case all the way to the Supreme Court in order to align federal law with how Congress has acted for years.”

While the Biden administration’s push to reschedule marijuana would help solve marijuana operators’ federal tax woes, neither rescheduling nor modest Congressional reforms such as the SAFER Banking Act “solve the fundamental issue,” Weiss added.

“The application of the CSA to lawful state-run cannabis business is an unconstitutional overreach on state sovereignty that has led to decades of harm, failed businesses, lost jobs, and unsafe working conditions.”

Business

Alabama to make another attempt Dec. 1 to award medical cannabis licenses

Alabama regulators are targeting Dec. 1 to award the first batch of medical cannabis business licenses after the agency’s first two attempts were scrapped because of scoring errors and litigation.

The first licenses will be awarded to individual cultivators, delivery providers, processors, dispensaries and state testing labs, according to the Alabama Medical Cannabis Commission (AMCC).

Then, on Dec. 12, the AMCC will award licenses for vertically integrated operations, a designation set primarily for multistate operators.

Licenses are expected to be handed out 28 days after they have been awarded, so MMJ production could begin in early January, according to the Alabama Daily News.

That means MMJ products could be available for patients around early March, an AMCC spokesperson told the media outlet.

Regulators initially awarded 21 business licenses in June, only to void them after applicants alleged inconsistencies with how the applications were scored.

Then, in August, the state awarded 24 different licenses – 19 went to June recipients – only to reverse themselves again and scratch those licenses after spurned applicants filed lawsuits.

A state judge dismissed a lawsuit filed by Chicago-based MSO Verano Holdings Corp., but another lawsuit is pending.

Source: https://mjbizdaily.com/alabama-plans-to-award-medical-cannabis-licenses-dec-1/

-

Business2 years ago

Business2 years agoPot Odor Does Not Justify Probable Cause for Vehicle Searches, Minnesota Court Affirms

-

Business2 years ago

Business2 years agoNew Mexico cannabis operator fined, loses license for alleged BioTrack fraud

-

Business2 years ago

Business2 years agoAlabama to make another attempt Dec. 1 to award medical cannabis licenses

-

Business2 years ago

Business2 years agoWashington State Pays Out $9.4 Million in Refunds Relating to Drug Convictions

-

Business2 years ago

Business2 years agoMarijuana companies suing US attorney general in federal prohibition challenge

-

Business2 years ago

Business2 years agoLegal Marijuana Handed A Nothing Burger From NY State

-

Business2 years ago

Business2 years agoCan Cannabis Help Seasonal Depression

-

Blogs2 years ago

Blogs2 years agoCannabis Art Is Flourishing On Etsy