Business

Alaska ranks highest, New Jersey lowest in adult-use marijuana taxes, report says

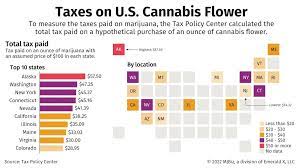

Alaska’s recreational marijuana taxes are the highest in the country, and New Jersey’s are the lowest.

That’s according to Richard Auxier and Nikhita Airi, the authors of the Urban-Brookings Tax Policy Center’s September report, “The Pros and Cons of Cannabis Taxes.”

But it’s a tough comparison to make. No two states where adult-use marijuana is legal approach cannabis taxes the same way.

“Every state is a special and unique flower,” Auxier, senior policy analyst for the Tax Policy Center, told MJBizDaily.

From excise taxes to weight-based taxes to potency taxes to wholesale taxes and their respective rates, those discrepancies can make it difficult to compare adult-use marijuana taxes across the United States.

Such a patchwork can also complicate tax planning for cannabis businesses with aspirations to expand to multiple states.

That’s why Auxier and Research Analyst Nikhita Airi took a creative approach to examining marijuana taxes in various states in their report: comparing the taxes on a retail purchase of 1 ounce of cannabis flower in the 19 states where adult-use taxes were enacted by September 2022.

To create the comparison without getting bogged down in price discrepancies between states, Auxier and Airi decided that the hypothetical retail price of an ounce of cannabis flower before taxes in each state is $100 – a round number that falls between the wholesale cost of an ounce in Colorado ($44) and Nevada ($130).

The authors acknowledge that the actual retail price of an ounce would be higher for customers in most states.

To deal with THC-potency tax rates in some states, Auxier and Airi’s hypothetical ounces all came in at 20% THC.

And to keep it simple, wholesale taxes were applied to the purchase price for each ounce, and it was assumed all wholesale taxes were passed on to customers.

By far, Alaska had the highest estimated tax on an ounce at $57.50, largely attributed to the $50-per-ounce tax on cannabis flower in that state.

It’s the highest weight-based tax rate in the United States. The remaining $7.50 is from a local percentage of price excise tax in Anchorage.

But Auxier and Airi weren’t critical of the high tax rate, advising that it’s much easier to decrease a tax rate in the future than to raise it.

“There’s no failure at the outset because we’re all trying and learning,” Auxier said.

“If there’s ever a failure, it’s because you don’t update and change as circumstances change.”

Washington state had the second-highest total taxes on a hypothetical ounce at $47.25.

But the authors warn that prices in Washington state are lower than average, meaning that the actual price of the ounce would be lower.

And because all cannabis taxes are calculated as a percentage of the retail price, the total tax paid on an ounce would very likely be lower.

New Jersey and Michigan had the lowest total taxes on a hypothetical ounce at $14.32 and $16, respectively.

Michigan, with its higher retail prices and only a 10% excise tax and a 6% general sales tax, is a fairly accurate estimate.

At 6.625%, New Jersey’s tax rate is intentionally low to help legal businesses compete with the unregulated market.

But similar to California, local governments in New Jersey can add a gross receipts tax on regulated retailers, distributors and cultivators.

That means the authors could have underestimated the total tax on an ounce in New Jersey, where it’s difficult to calculate where a local tax is being applied.

For the purposes of the calculation, the authors added a 2% gross receipts tax to three parts of the supply chain: cultivation, distribution and retail.

It also means New Jersey is on the list of states the authors are watching.

Will the market play out similarly to California, where local taxes are also common, or are the markets different in other ways?

“(The gross receipts tax) is the one that businesses really hate,” said Auxier, referring to the tax California municipalities levy on cannabis purchases.

“You’d think New Jersey would learn from California. (State regulators) actually did considerable work on how tax revenue would help fund programs for social equity and how taxes need to be low to compete with illicit sellers, but they also went ahead with allowing the gross receipts tax.”

As for states with a cannabis tax the authors approve of?

“I like New Mexico because they just did a simple retail tax, but they did it so that the rate escalates” Auxier said.

By 2025, New Mexico’s cannabis retail tax will increase from 12% to 13%.

“It’s basically assuming that the price of the product will come down,” Auxier added.

More highlights from the report and its authors:

- 2022 was the first fiscal year in which any state cannabis tax revenue declined from the previous year: California, Colorado, Nevada, Oregon and Washington – the more mature legal markets – all saw declines, while Alaska stayed flat.

- For fiscal year 2022, California collected the most state cannabis tax revenue at $744.4 million, or $20 per capita. Cannabis taxes accounted for 0.3% of total state tax revenue (excluding local taxes).

- Washington state and Colorado had the highest per capita taxes for fiscal year 2022, at $67 and $61, respectively.

- Maine had the lowest per capita total for state cannabis taxes, at just $13 per capita.

- The most popular approach to taxation of marijuana is through a retail tax, which is more streamlined from an administrative perspective. Wholesalers don’t have to pay it out, for example.

- The authors didn’t investigate a relationship between high taxes and illicit markets while cautioning that other factors are related to how a legal market is operating, such as how many and where legal stores are.

- Local taxes are among the most burdensome on consumers and have been blamed for some of the challenges facing the industry in California, for example. But they are often necessary for municipal governments to buy into allowing cannabis businesses to open.

- Potency-based taxes are designed to disincentivize consumers from buying higher-potency products, but they could also incentivize consumers to buy potent products from the illicit market.

- Connecticut and New York’s forthcoming adult-use cannabis markets will be the first to levy a tax calculated per milligram of THC. Illinois also taxes cannabis based on potency, but that state assigns a higher sales-tax percentage to more potent products.

Source: https://mjbizdaily.com/alaska-ranks-highest-new-jersey-lowest-in-adult-use-marijuana-taxes/

Business

New Mexico cannabis operator fined, loses license for alleged BioTrack fraud

New Mexico regulators fined a cannabis operator nearly $300,000 and revoked its license after the company allegedly created fake reports in the state’s traceability software.

The New Mexico Cannabis Control Division (CCD) accused marijuana manufacturer and retailer Golden Roots of 11 violations, according to Albuquerque Business First.

Golden Roots operates the The Cannabis Revolution Dispensary.

The majority of the violations are related to the Albuquerque company’s improper use of BioTrack, which has been New Mexico’s track-and-trace vendor since 2015.

The CCD alleges Golden Roots reported marijuana production only two months after it had received its vertically integrated license, according to Albuquerque Business First.

Because cannabis takes longer than two months to be cultivated, the CCD was suspicious of the report.

After inspecting the company’s premises, the CCD alleged Golden Roots reported cultivation, transportation and sales in BioTrack but wasn’t able to provide officers who inspected the site evidence that the operator was cultivating cannabis.

In April, the CCD revoked Golden Roots’ license and issued a $10,000 fine, according to the news outlet.

The company requested a hearing, which the regulator scheduled for Sept. 1.

At the hearing, the CCD testified that the company’s dried-cannabis weights in BioTrack were suspicious because they didn’t seem to accurately reflect how much weight marijuana loses as it dries.

Company employees also poorly accounted for why they were making adjustments in the system of up to 24 pounds of cannabis, making comments such as “bad” or “mistake” in the software, Albuquerque Business First reported.

Golden Roots was fined $298,972.05 – the amount regulators allege the company made selling products that weren’t properly accounted for in BioTrack.

The CCD has been cracking down on cannabis operators accused of selling products procured from out-of-state or not grown legally:

- Regulators alleged in August that Albuquerque dispensary Sawmill Sweet Leaf sold out-of-state products and didn’t have a license for extraction.

- Paradise Exotics Distro lost its license in July after regulators alleged the company sold products made in California.

Golden Roots was the first alleged rulebreaker in New Mexico to be asked to pay a large fine.

Source: https://mjbizdaily.com/new-mexico-cannabis-operator-fined-loses-license-for-alleged-biotrack-fraud/

Business

Marijuana companies suing US attorney general in federal prohibition challenge

Four marijuana companies, including a multistate operator, have filed a lawsuit against U.S. Attorney General Merrick Garland in which they allege the federal MJ prohibition under the Controlled Substances Act is no longer constitutional.

According to the complaint, filed Thursday in U.S. District Court in Massachusetts, retailer Canna Provisions, Treevit delivery service CEO Gyasi Sellers, cultivator Wiseacre Farm and MSO Verano Holdings Corp. are all harmed by “the federal government’s unconstitutional ban on cultivating, manufacturing, distributing, or possessing intrastate marijuana.”

Verano is headquartered in Chicago but has operations in Massachusetts; the other three operators are based in Massachusetts.

The lawsuit seeks a ruling that the “Controlled Substances Act is unconstitutional as applied to the intrastate cultivation, manufacture, possession, and distribution of marijuana pursuant to state law.”

The companies want the case to go before the U.S. Supreme Court.

They hired prominent law firm Boies Schiller Flexner to represent them.

The New York-based firm’s principal is David Boies, whose former clients include Microsoft, former presidential candidate Al Gore and Elizabeth Holmes’ disgraced startup Theranos.

Similar challenges to the federal Controlled Substances Act (CSA) have failed.

One such challenge led to a landmark Supreme Court decision in 2005.

In Gonzalez vs. Raich, the highest court in the United States ruled in a 6-3 decision that the commerce clause of the U.S. Constitution gave Congress the power to outlaw marijuana federally, even though state laws allow the cultivation and sale of cannabis.

In the 18 years since that ruling, 23 states and the District of Columbia have legalized adult-use marijuana and the federal government has allowed a multibillion-dollar cannabis industry to thrive.

Since both Congress and the U.S. Department of Justice, currently headed by Garland, have declined to intervene in state-licensed marijuana markets, the key facts that led to the Supreme Court’s 2005 ruling “no longer apply,” Boies said in a statement Thursday.

“The Supreme Court has since made clear that the federal government lacks the authority to regulate purely intrastate commerce,” Boies said.

“Moreover, the facts on which those precedents are based are no longer true.”

Verano President Darren Weiss said in a statement the company is “prepared to bring this case all the way to the Supreme Court in order to align federal law with how Congress has acted for years.”

While the Biden administration’s push to reschedule marijuana would help solve marijuana operators’ federal tax woes, neither rescheduling nor modest Congressional reforms such as the SAFER Banking Act “solve the fundamental issue,” Weiss added.

“The application of the CSA to lawful state-run cannabis business is an unconstitutional overreach on state sovereignty that has led to decades of harm, failed businesses, lost jobs, and unsafe working conditions.”

Business

Alabama to make another attempt Dec. 1 to award medical cannabis licenses

Alabama regulators are targeting Dec. 1 to award the first batch of medical cannabis business licenses after the agency’s first two attempts were scrapped because of scoring errors and litigation.

The first licenses will be awarded to individual cultivators, delivery providers, processors, dispensaries and state testing labs, according to the Alabama Medical Cannabis Commission (AMCC).

Then, on Dec. 12, the AMCC will award licenses for vertically integrated operations, a designation set primarily for multistate operators.

Licenses are expected to be handed out 28 days after they have been awarded, so MMJ production could begin in early January, according to the Alabama Daily News.

That means MMJ products could be available for patients around early March, an AMCC spokesperson told the media outlet.

Regulators initially awarded 21 business licenses in June, only to void them after applicants alleged inconsistencies with how the applications were scored.

Then, in August, the state awarded 24 different licenses – 19 went to June recipients – only to reverse themselves again and scratch those licenses after spurned applicants filed lawsuits.

A state judge dismissed a lawsuit filed by Chicago-based MSO Verano Holdings Corp., but another lawsuit is pending.

Source: https://mjbizdaily.com/alabama-plans-to-award-medical-cannabis-licenses-dec-1/

-

Business2 years ago

Business2 years agoPot Odor Does Not Justify Probable Cause for Vehicle Searches, Minnesota Court Affirms

-

Business2 years ago

Business2 years agoNew Mexico cannabis operator fined, loses license for alleged BioTrack fraud

-

Business2 years ago

Business2 years agoAlabama to make another attempt Dec. 1 to award medical cannabis licenses

-

Business2 years ago

Business2 years agoWashington State Pays Out $9.4 Million in Refunds Relating to Drug Convictions

-

Business2 years ago

Business2 years agoMarijuana companies suing US attorney general in federal prohibition challenge

-

Business2 years ago

Business2 years agoLegal Marijuana Handed A Nothing Burger From NY State

-

Business2 years ago

Business2 years agoCan Cannabis Help Seasonal Depression

-

Blogs2 years ago

Blogs2 years agoCannabis Art Is Flourishing On Etsy